Bridging the wellness gap

No longer a luxury niche of spas, yoga and detox diets, wellness is now a multi-trillion dollar global industry

Wellness – loosely defined as activities, choices and lifestyles that enable holistic health and wellbeing – has been growing in importance for years. It has inspired new businesses, brands, products, services and experiences. It revolutionised entire industries and became as important as health, even for the pharma industry. Today, wellness covers sectors as diverse as real estate and tourism, is worth $4.5 trillion, and is growing twice as fast as the rest of the economy. 1

Ripe opportunities for growth

In April 2020, to discover what wellness means to today’s consumers, we conducted an online survey of 7,000 adults from 14 countries across Europe, Asia, Latin America and North America. Our timing gave the study particular resonance as, of course, it coincided with half the world’s population entering lockdown and wellbeing declining rapidly for millions. We asked respondents how important wellness is, what it represented for them and what actions they expect brands to take to help them improve their wellness.

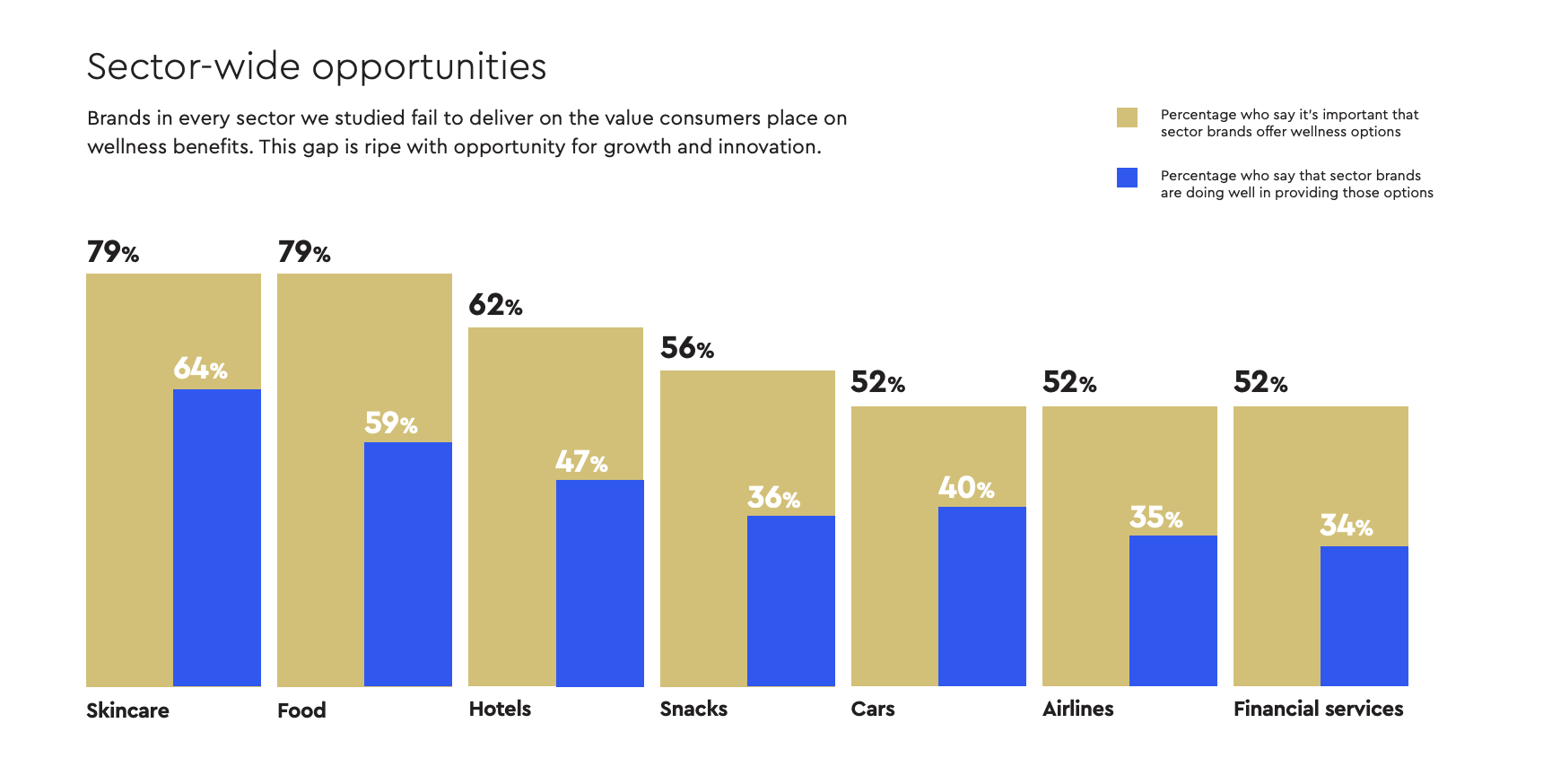

The most significant revelation was consumers’ strong demand for brands to have wellness in their core mission – and the gap between expectations and delivery. This gap is evident in every sector, as the graph below – tracking seven industries, half the wellness market – indicates. The industry-wide evidence of this mismatch shows that every sector is ripe with opportunity.

Wellness for many is the new purpose. Our study found that, for 73% of consumers, wellness is an essential element of a brand’s strategy. This not only covers expectations in related sectors, like food, but in less obvious industries like airlines, cars and even financial services. Across the board, consumers are prioritising wellness when they shop and are acutely aware of the mismatch between what they want and what brands deliver.

Today, 77% of people say wellness is very or extremely important to them – and yet they are still not satisfied with what brands are delivering. Four out of five, 80%, want to improve their wellness, yet 75% feel brands could do more in that regard. A striking 66% say that in future brands will need to have a wellness component to even survive. As we navigate to the ‘next normal’, post-Covid-19, we already see evidence that a brand’s wellness mission will become even more critical to growth.

Wellness – a largely uncharted territory

Take major wellness industries like food and skincare, which put wellness at the core of their priorities. Now, listen to consumers: is the food industry doing all it should to help them with their wellness? Just 41% say yes. Is the skincare industry doing all it should? Only 53% agree. And it is not just the ‘obvious’ wellness sectors that are letting consumers down. Across all industries, from hotels to cars, brands are failing to deliver on expectations. The conclusion is obvious, wellness is still a largely uncharted territory.

Good news, there are still numerous gaps to fill – and wellness remains synonymous with growth opportunities.

And wellness is no longer the preserve of ‘wellness brands’. Two out of three consumers, 67%, say there should be more wellness options. More than half, 52%, expect categories like cars, banks or airlines to offer wellness options – comparable to the snack foods category, 56%. Consumer logic is fool-proof. Most likely, bankers don’t discuss wellness much. But if consumers were in the C-suite of the banking industry, they would. Three-quarters, 75%, of them think lowering anxiety and stress is the job of a wellness brand. Money being people’s biggest source of stress, they would see immense growth opportunities in wellness. To cut a long story short, consumers expect every brand to contribute to their wellness. And 59% agree to pay more for it. What more could we ask?

It’s not new news that wellness is holistic, but holistic takes a new dimension nowadays. The traditional physical and mental factors of wellness are still critical – not a surprise in a world where chronic diseases are rapidly increasing, obesity and diabetes appear earlier in life and Covid-19 causes psychological disorders, stress, anxiety and depression.2,3 That’s why healthy meals, good sleep and time to relax remain people’s top three priorities.

What’s new is that wellness is less personal and selfish – shifting from ‘my’ to ‘our’ wellness. More than half, 53%, of consumers surveyed say a brand that helps them feel connected is a wellness brand; while 71% say one that helps them make a positive difference is a wellness brand. Personal ‘wellness bubbles’ are worthless unless the rest of the world feels well too.

In 2020, wellness gained two new facets: social and purposeful wellness. And again, this opens new opportunities for brands. Let’s take a word present in so many brand conversations – purpose – and look at it through the wellness lens. Since consumers tell us they feel well when they make a difference in the world, companies should stop thinking purpose is a social responsibility, and see it as a potential consumer benefit. When they wear TOMS shoes, consumers show to the world they have given a pair of shoes to people in need, and it makes them feel good. Caring for people in need is a consumer benefit of TOMS – but more importantly, it is a great reason to buy them, and an excellent excuse to do so again and again.

What makes a wellness brand?

Wellness is evolving, fast. When we asked consumers what made a wellness brand, conventional health-related factors didn’t sweep the board as expected. ‘Improves sleep quality’, with 79%, ‘nutritious’, also with 79%, and ‘helps me stay active’, 75%, earned similar ratings to more holistic concerns, such as ‘positive frame of mind’, 80%, ‘resilience’, 73%, and ‘promotes a sense of harmony’, 74%. Reflecting this wide canvas, consumers’ descriptions of wellness brands can be grouped into four sets:

- Physical – 86% say ‘helping me stay in good health’ is the most important attribute of a wellness brand

- Mental – 80% say putting them in a positive frame of mind is an important attribute of a wellness brand

- Social – 56% say wellness brands should ‘help me nurture or care for others’

- Purposeful – 71% say wellness brands should help them make a positive difference

Gaps in brand delivery

Brands need to address three types of gap:

- The availability gap: the product or service that consumers expect does not exist. Three-quarters (75%) say brands can do more to help them; 41% say they can’t find what they want at their preferred shops

- The authenticity gap: wellness claims need to be understandable and believable. Fifty-three per cent of consumers find it hard to tell the difference between real and fake wellness products and only 41% feel brands make wellness promises that are usually believable

- The value gap: wellness needs to tick several boxes. Almost three-quarters, 73%, of consumers say a wellness brand should feel like a good choice; 60% want good value for money, and 60% want the brand to be good for the environment

Building brand communities

Now, let’s think social wellness. Since people tell us wellness is increasingly linked to the sentiment of feeling connected, wellness is an opportunity for brands to tighten the bonds with their communities. And since people integrate wellness in all aspects of their lives, it opens opportunities to converge, partner and build synergies with other brands. In other words, looking at social strategy through the eyes of wellness can help brands grow their brand community exponentially. And when communities get bigger, and interactions get richer, brands get ready to make the most of social commerce.

Most likely, bankers don’t discuss wellness much. But if consumers were in the C-suite of the banking industry, they would.

Behaviour and digital, the new frontiers

We said it, consumers expect more. Three-quarters, 75%, say brands could do more to make wellness easier for their customers to achieve. Almost as many, 73%, expect them to embrace wellness as part of their core mission. Our report shows two conditions for brands to deliver more:

- Regaining trust – as wellness grows in importance, so do trust and honesty. Even more so after COVID-19 revived so many questions, fears and doubts. Re-establishing brand trust is a prerequisite to healthy growth. ‘Wellness marketing’ is dead. People want authentic stories, ingredients they understand, benefits they believe and, most importantly, brands that deliver on their promises

- Being a better wellness partner – only 46% of consumers say brands are helping them make their wellness a priority. Brands must better understand the difficulties to achieving wellness, behave as consumers wish and respect their commitments. Wellness is not a game you can win if you play alone, and brands have not yet performed well enough as partners

Making every brand a wellness brand

Some brands – such as those in health, fitness, personal care, nutrition and sleep – have an obvious wellness role. Wellness is often written into their brand proposition, ingredient story and messaging. Those without traditional wellness links can still find a place on the continuum, by building wellness into their brand behaviours, such as their sourcing, packaging and service development, and the employer brand experience.

Wellness can also inform their customer experience, and partnerships. In trust and partnership, we see another opportunity (yes, we told you, wellness offers a plethora of opportunities). We see two obvious routes to drive growth.

The first is the behavioural science route. Achieving wellness is first and foremost a matter of evolving one’s daily habits. It’s a personal, emotional journey, full of barriers and biases, with sticking to one’s commitments being an on-going challenge. We are convinced that brands have just exploited a tiny part of what behavioural science can bring to wellness. We are convinced there are dozens, probably hundreds, of unseen opportunities that remain to be unveiled and seized and that behavioural science is a new frontier for growth.

The second route, unsurprisingly, is digital. Digital has revolutionised every wellness market and is the prime route to personalisation. It allows brands to accompany and support customers at every step of their wellness journey; sharing their doubts, fears and small wins, and enabling them to progress together. The digital revolution will continue to bring innovations to market and will remain one of the most important ways to help consumers achieve their wellness goals, and brands to deliver their promises.

Thriving in the new wellness economy

The expansion of the world of wellness is not going to slow down and Covid-19 will accelerate the phenomenon. Consumers want to improve their wellness significantly – and they expect significantly more from brands. The research shows how seriously people take their wellness, and the role that brands can play. This is more than a trend. It reflects a deeper commitment to live well. To seize the manifold opportunities, brands need to reinvent, innovate, play with the fresh facets of wellness, and explore its new frontiers. Those that do will thrive in the new wellness economy.

|

published on

15 December 2021

Category

More in The Atticus Journal

Generative AI: mitigating risk to unlock opportunity

H+K’s Allison Spray on managing the commercial and reputational risks that the proliferation of generative AI will present

Making sustainability profitable

Sustainability investments must deliver returns – both financial and reputational – to be ‘sustainable’ for business. Something needs to change, says Luc Speisser

Sustainability comms must get real

There’s a disconnect between the way corporations talk about climate change and how the public discusses the same issue. That’s the conclusion of research by Jamie Hamill, Alessia Calcabrini and Alex Kibblewhite.