Future proof

COVID-19 changed retail forever but how are brands responding to the new business landscape?

The pandemic was a tipping point for online commerce. Digital kept the wheels turning, providing a lifeline to businesses and stuck-at-home consumers alike. This shines through clearly in The future shopper report 2021 – which surveyed 28,000 people across 17 markets – with 72% of consumers saying online shopping came to their rescue, and 73% predicting it will be even more important this year.

Tech-savvy consumers

The closure of physical stores, and the need to buy digitally, led to notable shifts in consumer behaviour, with 80% of respondents saying they changed the way they shop. Thirty per cent say it changed permanently, while 50% expect to retain some pandemic shopping habits. Sixty per cent say they are now more comfortable using digital tech, with 62% planning to use digital channels more. In contrast, 41% are still frightened about shopping in-store. Fear about returning to stores presents a particular issue for retailers who do not have a digital-only, digital-first, or even omnichannel business model.

However, we should not ring the death knell for physical retail. Consumers clearly crave innovative, omnichannel shopping experiences. More than three in five respondents, 62%, think brands need physical stores – up from 51% last year – and 64% prefer to shop with brands that are online and offline. Notably, 59% say they wished brands would communicate seamlessly across all channels. Interestingly, younger shoppers are most interested in having better omnichannel options.

Post-COVID-19 expectations have changed, too. People are less prepared to put up with mediocre shopping experiences. Almost three-quarters, 73%, say retailers need to get better at giving them their chosen products, services and experiences. More than half, 56%, say they won’t shop with anyone who doesn’t meet their digital expectations.

Shoppers are spending more online. Consumers reported that, pre-pandemic, their online-offline spending split was 45% to 55%, with the online share soaring to 61% at the height of the restrictions. Consumers are now saying their spending split is 51% online versus 49% offline – a fall since lockdown’s peak, but a rise from pre-COVID-19.

The rise and rise of marketplaces

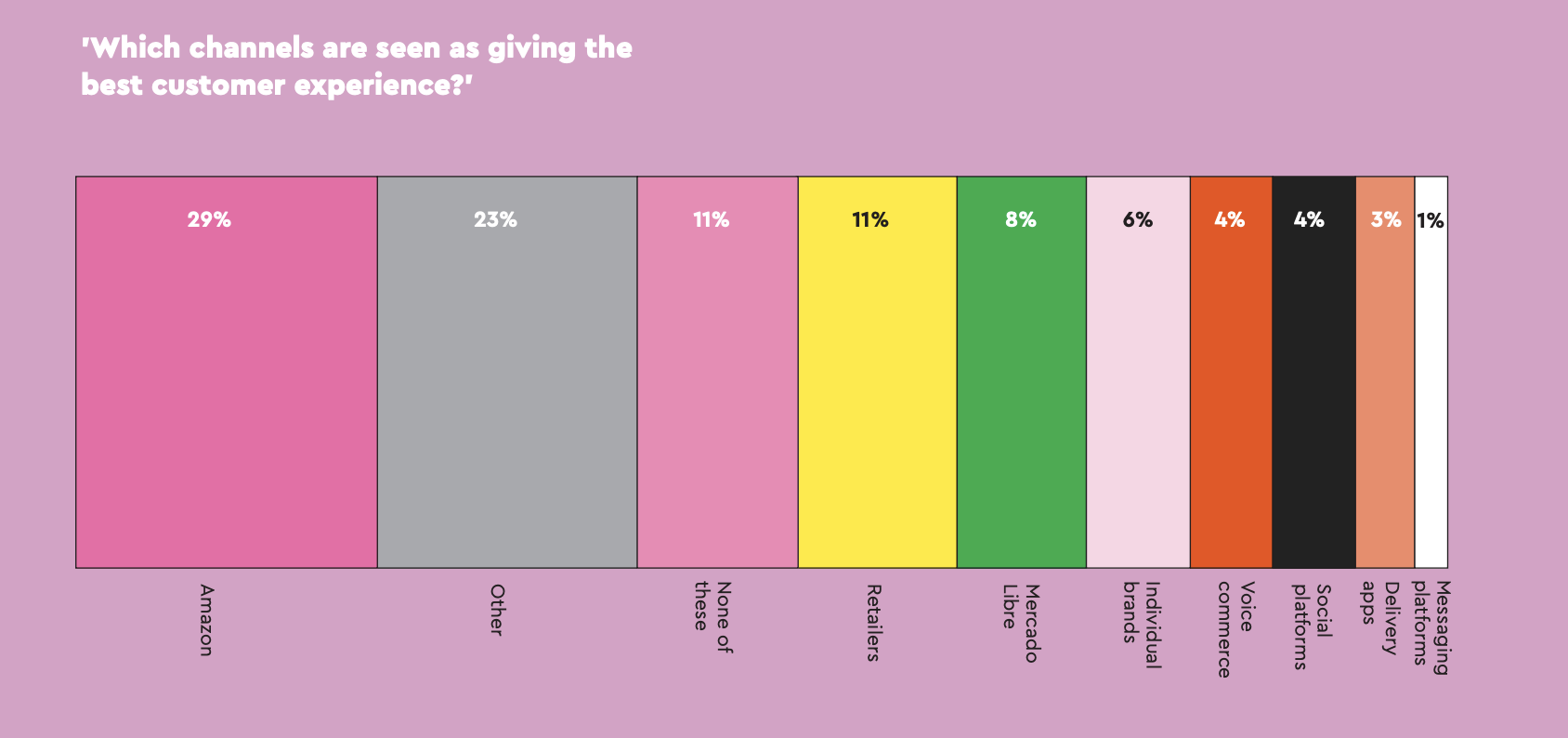

Amazon came top of every category we quizzed shoppers on – a testament to its standing and the quality of its offered experience. It was rated by 29% as delivering the best experience across all categories, way out in front of ‘other marketplaces’, 23%. However, Amazon is not alone. Around the world, marketplaces are where consumers make more than a third of their online purchases; Amazon combined with other marketplaces and Mercado Libre represent 42% of the global wallet.

There are a range of markets where Amazon is not dominant and in a number of these, such as Brazil, Japan and China, other marketplaces take the biggest share of purchases across all categories combined. When we asked consumers where they spent their money online, ‘other marketplaces’ – including the Chinese giants Alibaba, JD.com and Pinduoduo, and eBay and Gumtree – came first with 23%, pushing Amazon into third place, after supermarkets and grocers. There is a pattern when it comes to service perceptions: in countries where Amazon is most established it is streets ahead in customer ratings of its service and experience. Likewise, in regions where other marketplaces are dominant, they win the approval of local consumers hands down.

Where competition between rival marketplaces is tightest, Amazon performs particularly well in consumers’ eyes on delivery. An obvious inference is that this reputation is built on Prime, its paid-for membership scheme that pioneered free next-day delivery. Worldwide, 32% of consumers say they are Prime members. Prime users make double the average number of purchases from Amazon than non-Prime members. This means members are buying through Amazon as regularly as all consumers buy through supermarkets and grocers, the most frequently used channel overall.

Identifying marketplace gaps

In certain nations, marketplaces don’t top purchase intent; in Australia, for example, brand sites, 23%, and retailer sites, 20%, take the biggest share. And two-thirds, 65%, of consumers say they would rather go to the supermarket or order their groceries online from one than through Amazon. To capitalise on the spaces left between marketplaces, brands and retailers must understand where consumers want an alternative. When we asked consumers why they would choose another online retailer over Mercado Libre, Amazon or Lazada, cheaper pricing came out as the most popular answer, followed by more convenient delivery options.

Nearly two-thirds of consumers, 64%, say they are excited by the prospect of buying everything online through a single retailer, with the only dissenters being the Netherlands and Australia, and those aged 55 or over. For most, this represents the ultimate one-stop retail experience, providing convenience, value, good service, and a short, seamless journey to purchase.

Marketplaces may have conquered ‘traditional’ online commerce – but their ambitions don’t stop there. Worldwide, Amazon accounts for more than a quarter, 28%, of all online entertainment purchases, its biggest share of any single category. Through Prime Video, it has become a key figure in the sports broadcasting market, rivalling incumbent media companies with big-money rights purchases and largely pay-per-view packages. It also has eyes on the financial services industry. More than half, 54%, of consumers say they would be open to banking through it (likewise Mercado Libre or Lazada in their markets).

Marketplaces lead ideas and search

Marketplaces are top for inspiration and search, as well as for a growing range of sales. In the search for digital shopping inspiration, Amazon remains the beacon in the United States, the UK, Germany, and Spain, with more than half of consumers using it for ideas. However, marketplaces other than Amazon score highly where they still out-compete it. For example, Mercado Libre is the most popular inspiration channel in Latin America.

Search is no longer the obvious place to start an online shopping journey. In countries including the UK, the United States, Spain and India, 59% use Amazon to search for products, compared with 38% globally. Indeed, in nearly all markets surveyed, the top two search preferences were either Amazon or alternate marketplaces, plus search engines. The big mover is social media; mentioned by just 8% of respondents last year, it is now the third favourite search option for United States consumers, at 28%.

As always, price is the greatest influencer of online purchasing: 94.8% of respondents say price is important, 64.5% say it is very important. However, we can see from other cited influencers – such as accurate product descriptions, stock availability and customer service – that consumers judge value on more than price alone. Brands and retailers clearly need to have a firm grip on the entirety of their commerce operations.

D2C grows on the back of digital

The boom in digital commerce throughout the pandemic created new opportunities for brand sites. In grocery, for example, when delivery slots were scarce, the likes of Heinz and Pepsi launched D2C (direct to consumer) services to get products to customers. This suggests D2C is on the rise. And when we asked consumers where they were most likely to buy items, brand sites averaged 15% across all sectors, behind marketplaces. And some countries rank brand sites even higher than marketplaces – in Australia, France and Colombia, D2C is the single most popular online channel.

However, despite its second position behind marketplaces in terms of purchase intent, D2C only claims the sixth largest share of sales online, accounting for 8% of consumer digital spend. And, when it came to the best shopping experience, D2C ranked fifth overall with an average score of 6%, well behind Amazon, other marketplaces and retailer sites.

We asked digital shoppers what would encourage them to buy products from a brand online. Fifty-eight per cent said a better price, down from 77% last year – 29% 23% 11% 11% 8% 6% 4% 4% 3% 1% 'Which channels are seen as giving the best customer experience?' Amazon Other these None of Retailers Libre Mercado brands Individual commerce Voice platforms Social apps Delivery platforms Messaging WPP Atticus 26 suggesting brands have more scope to compete than on price alone. In second place was free delivery, followed by free returns and fast and convenient delivery. In other words, service is key to consolidating brand site success.

Social commerce burgeons

Social media has long been a channel to watch in digital commerce. The big attraction is market reach, with the Facebook group (which includes Instagram and WhatsApp) in the billions. This year, 44% of consumers say they have bought from a social platform, with 24% saying they have followed links or ads from social media and purchased from the end retailer or brand site. There is a significant age gap in social commerce interest: 74% of over-55s say they have never bought from social, whereas 55% of 25-to-34-year-olds say they have. Thirty-seven per cent of consumers say deals and discounts would persuade them to engage more.

When we asked consumers which platform they were most likely to buy from, and which was best for social commerce, Facebook led in both areas, according to almost one-third of consumers. And a massive 54% say they are most likely to buy through Facebook or Instagram if they did use social commerce. That puts the pair in a hugely dominant position. There is a good argument that any social strategy should start with Instagram for youngsters, and Facebook for slightly older shoppers. That said, in China, TikTok is the hottest social commerce ticket. It accounts for 68% of social purchases, with 70% rating it best for social commerce. It enjoyed phenomenal growth outside China during the pandemic and is estimated to now have 100 million active monthly users in both the United States and Europe.

Consumers back digital innovation

Any doubts about consumer desire to see shopping digitally transformed, were extinguished with COVID-19. Two-thirds, 66%, say they wish brands were more digitally innovative – up from 52% in 2020. And 60% say they are more likely to buy from a digitally innovative brand. In terms of future innovations, 60% say they are excited about a future with cashless payments, up from 44% in 2020, and 62% look forward to no check-out, no-queue stores.

Consumers want to see digital tech taking over in physical stores, too, welcoming the idea of biometric payments, or using parts of the body to authorise cashless spending. And 76% say they would be happy for retailers and brands to use their purchase history and preference data to send them free samples.

Consumers are also increasingly buying digital products, with 33% of online spend going on digital services. And 46% say they would prefer online purchases to be digital and instantly downloadable, up from 34% in 2020. Brands and retailers should think creatively about what they can offer in a digital format, whether they can develop digitised services, and if digitisation could add value to the customer experience or be monetised directly.

Gaming was another digital area that exploded during the pandemic. Interestingly, from a commercial perspective, 59% of people who play games say they spend money via their games platforms, with 50% of all online consumers doing so through video game platforms. That makes gaming a significant and interesting commerce channel in its own right.

Ethics and sustainability

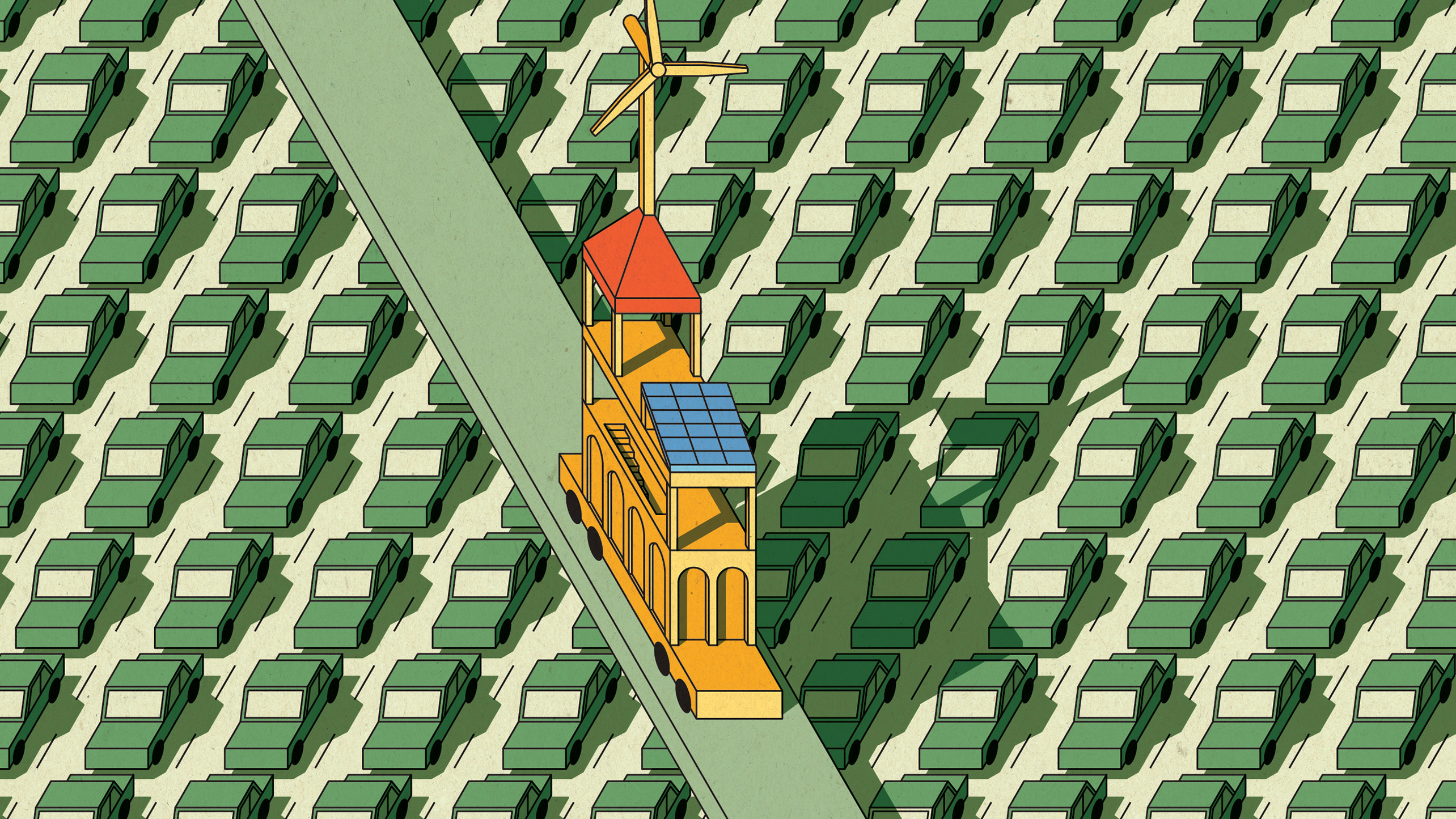

Fears that the pandemic would lead to consumers swapping their principles for pragmatism appear unfounded. Nearly three-quarters, 71%, say they wished brands and retailers would follow better environmental practices such as less packaging, reduced carbon footprints and eco-delivery vehicles – the same as last year. Even more significantly, 67% say they consider a company’s ethics when making purchasing decisions, with 60% claiming they actively choose companies that are more environmentally responsible – up from 55% and 46% in 2020.

Our research proves that COVID-19 revolutionised the way we shop. To take advantage of the opportunities created, brands and retailers must hone a balanced omnichannel strategy that treats all channels, online and offline, as complementary parts of the larger whole. They need to embrace innovation and new technology at every stage of the customer journey, and to explore partnerships at the same time as driving their own offer. Above all, they require a deep understanding of their market, customer base, and local and regional conditions. This is key to gaining the necessary insights to respond effectively to the challenges of post-pandemic commerce and to laying the foundations for future success.

published on

15 December 2021

Category

More in The Atticus Journal

Generative AI: mitigating risk to unlock opportunity

H+K’s Allison Spray on managing the commercial and reputational risks that the proliferation of generative AI will present

Making sustainability profitable

Sustainability investments must deliver returns – both financial and reputational – to be ‘sustainable’ for business. Something needs to change, says Luc Speisser

Sustainability comms must get real

There’s a disconnect between the way corporations talk about climate change and how the public discusses the same issue. That’s the conclusion of research by Jamie Hamill, Alessia Calcabrini and Alex Kibblewhite.