Brand building throughout the buyer life cycle

A positive holistic experience encourages customer growth

Over the past few years we have heard a lot about the need for companies to pursue customer-centric growth. But how easy is this when different functions focus on different activities with different key performance indicators? Customer experience may differ dramatically depending on where they are in the buyer life cycle. For instance, while new customers are wooed with special offers, existing customers feel neglected and wonder why they are not getting the same deal.

In reality your customers don’t distinguish between your product lines, service staff, call centre, website, or social feeds. They experience your brand as one entity and their impressions and associations of that one entity will determine whether they want to use your product or service. Moreover, the customer experience changes over time, moving from incidental exposure to a brand for which they have no need and little interest in, to an intimate understanding of what your brand has to offer.

The buyer life cycle

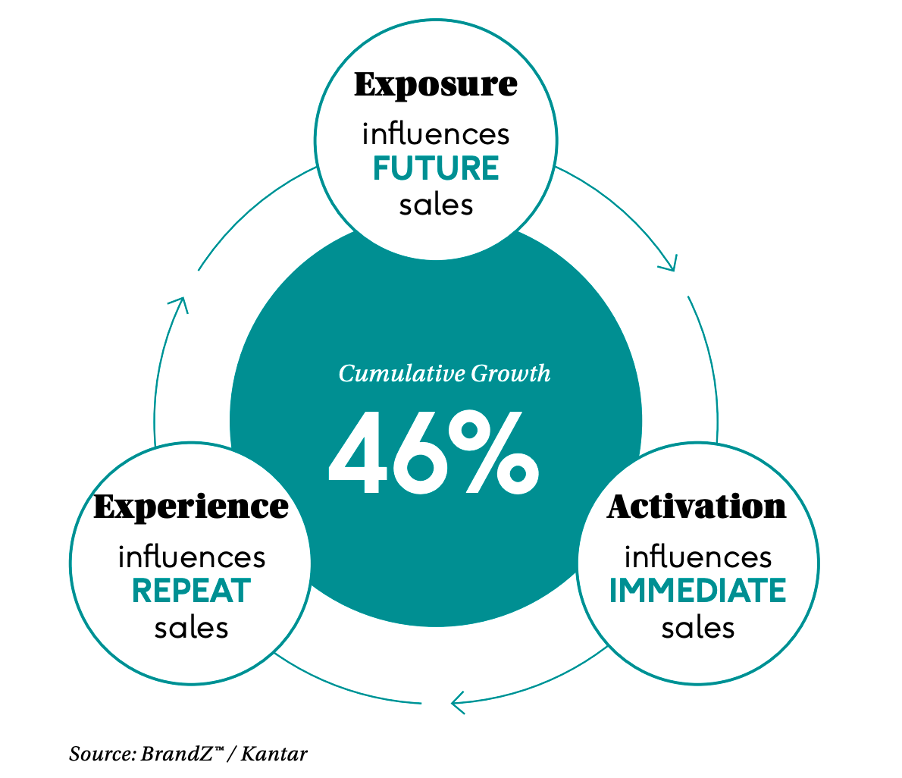

For companies to drive customer-centric growth, they need to create a holistic view of how well they are creating the potential for growth across the buyer life cycle. We can envisage this as three stages: experience, exposure, and activation.

We analysed a wide variety of brands measured in BrandZ™ across a three-year timeframe, and our findings were surprising. Only 4% of brands outperformed the average at all three stages – but this group grew usage by an average of 46%.

Brands need to retain at least their fair share of existing customers in order to grow. And though actual experience of a product has an obvious impact on the willingness to buy again, marketing can also shape that experience.

Predisposing new customers

As well as retaining existing customers, brands need new customers to grow. Your marketing might target prospective buyers, but until they need a product or service like yours, potential customers will only have an impression of what your brand stands for, gleaned from fleeting references in conversation and casual exposure. Shaping the right impression and creating a predisposition to choose your brand is critical to growth. Our analysis finds that, on average, brands that under-perform at the exposure stage do not grow.

Over the last decade – encouraged by readily available, short-term, volume-oriented metrics – companies have increasingly invested in activation: targeting and incentivising people who are actively exploring their category. However, our analysis finds that two-thirds of growth comes from people who are already predisposed to choose a specific brand. Turning that predisposition into sales is less a matter of incentives than making sure your brand is easy to remember and easy to buy.

Brand building success stories

One brand that has found renewed success through a more balanced and informed approach to brand building is adidas, which ranked No. 100 in last year’s BrandZ™ Global Top 100, rising eight places this year to No. 92. However, back in 2014, when adidas was suffering from declining global sales and market share losses in the US, CMO Eric Liedtke introduced a plan to drive brand desire by leveraging popular culture.

Then in 2017, new CEO Kasper Rorsted introduced organisational changes under the title ‘One adidas’. He announced a plan to reduce the number of products with the aim of increasing the price point and to focus on ecommerce sales as these were the most profitable.

Market-mix modelling highlighted the halo effects of marketing across product categories and across retail channels, dispelling the assumption that digital advertising drove digital sales, and identifying that performance marketing underperformed brand marketing in terms of return on investment.

Brand equity over digital advertising

Adidas is not alone in discovering that an over-investment in digital advertising designed to activate immediate sales can undermine longer-term success. In the UK insurance market, Direct Line Group identified that a substantial proportion of revenues were being driven by brand equity, leading to increased investment in brand building and TV advertising. BrandZ™ data identified that this investment increased the proportion of people predisposed to choose Direct Line and strengthened perceptions that the brand was worth the price. As a result, the group’s sales and share improved even though it was operating in a market dominated by price comparison websites.

Both these examples demonstrate why it’s important to understand the real drivers of sales, rather than rely on short-term performance metrics. And this doesn’t just apply to media. Adidas identified that its customer relationship marketing was over-investing in the minority of people who bought four or more pairs of sneakers per year. Focusing instead on the 60% of buyers who only bought once in a year but might be encouraged to buy again could potentially be much more effective. Findings like this confirm that companies cannot afford to have a siloed view of the people who buy or might buy their brand.

Clear, consistent and coherent

Like adidas and Direct Line, the brands that grow market share most strongly are the ones that use their resources to deliver a clear, consistent and coherent impression across the buyer life cycle. Existing users don’t feel ignored; potential users know what the brand stands for and are not motivated by unsustainable claims; and messaging at point-of-choice reinforces existing perceptions without defaulting to unnecessary incentives.

Central to success is a coherent set of key performance indicators that create a holistic view of the brand across the buyer life cycle based on metrics that assess the brand’s performance at each stage and reflect what drives growth over time.

published on

27 July 2020

Category

More in Experience

Let’s add audio for visually impaired audiences

How to make advertising more accessible for visually impaired audiences

The Future 100: wellbeing, humanity, emotion and tech

This annual trend spotter – by WPP’s VML – gives us the context for the new normal for marketing in 2024.

Activating sports events – the ultimate balancing act

WPP Sports Practice takes a look at the art of timing for sports event activation