Winter holiday highlights

Trends in TV and paid search retail advertising for the first half of the 2019 holiday season

Thanksgiving Day sales used to mark the start of the holiday shopping season. But while the five-day weekend is still one of the busiest for retail, sales have been inching forward in the calendar, as well as lasting longer throughout the season, giving shoppers a longer window of opportunity to get good deals.

Retailers are eager to connect with holiday shoppers during this crucial period and, with keener competition than ever, advertising plays a critical role. According to the National Retail Federation (NRF), nearly 190 million Americans shopped in stores and online from Thanksgiving Day to Cyber Monday 2019.

Kantar’s research reveals that these holiday weeks remain as competitive as ever, with new leaders emerging and strategies shifting from some of the biggest retailers in the game.

The right time to shine

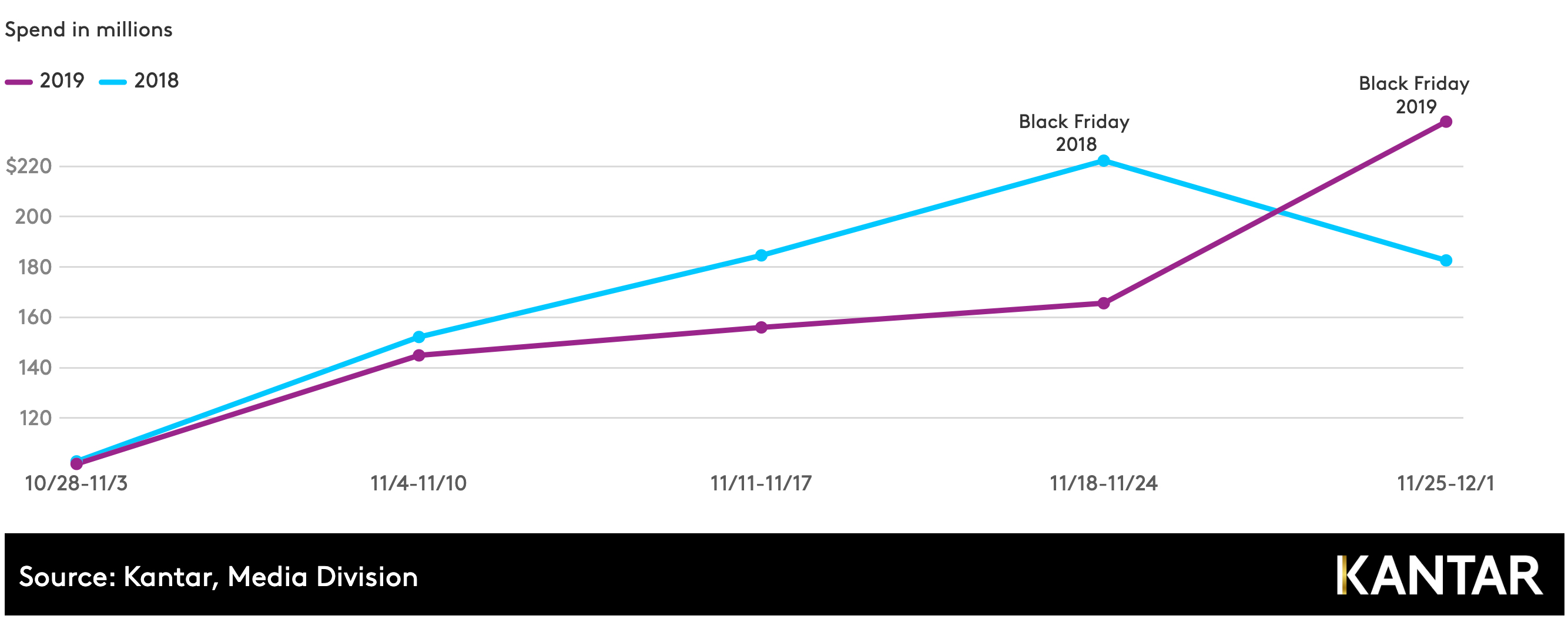

Thanksgiving fell a week later than usual in 2019, and retailers adjusted their advertising budgets accordingly. A comparison of weekly expenditures leading up to Black Friday in 2019 vs 2018 shows spend levels were off to a slower start.

However, Black Friday week ended stronger this year than last, indicating retailers were holding back to reach shoppers closer to the anticipated long weekend. The increasing prevalence of fast and free online shipping may also be encouraging procrastinators. (This year, the final date Amazon Prime members can get free delivery for Christmas is 22 December.)

Winter Holiday Season Weekly Retail Advertising Spend, National TV: 28 October - 1 December, 2019

Overall during the five measured weeks, total spend on National TV from retail advertisers reached $808 million, down 5% compared with the $847 million spent during the similar period in 2018. However, actual spending on the Black Friday week was higher in 2019, at $238 million as compared with $222 million. The gap may be due to a slower start and could begin to narrow as we move further into the season.

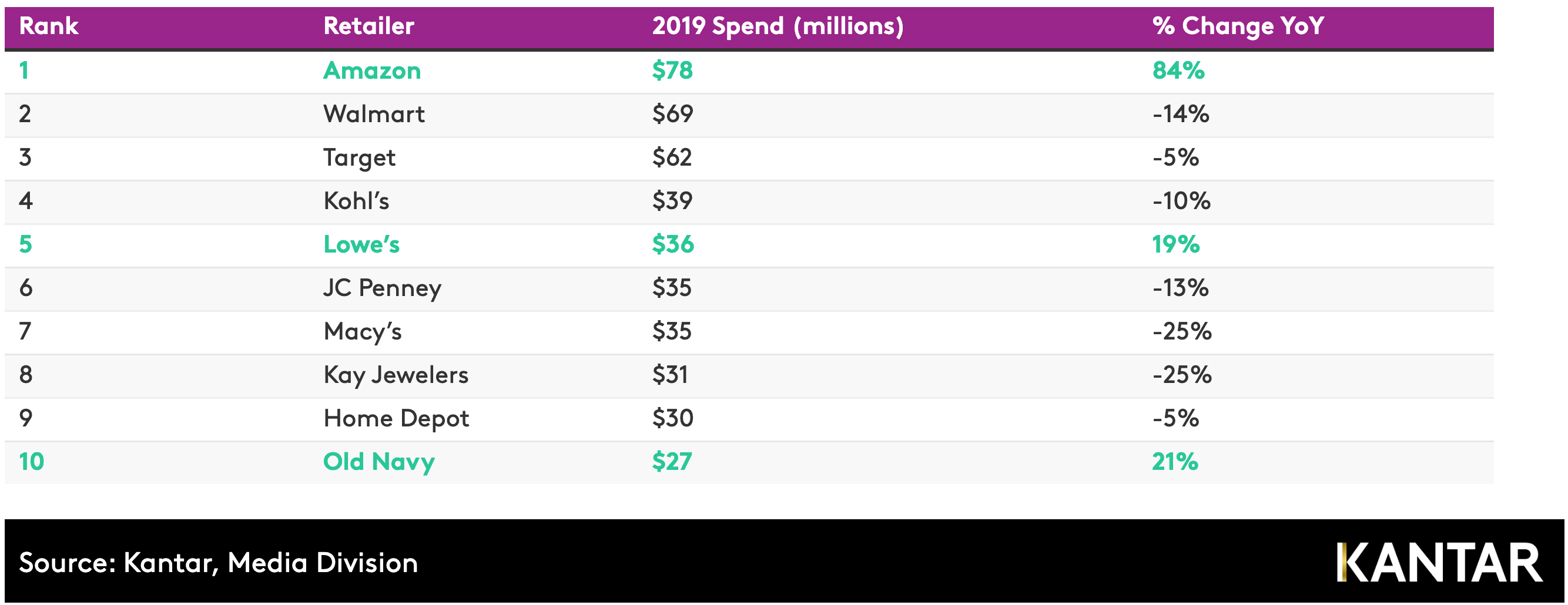

Amazon takes the lead

Looking at the top 10 retail advertisers up until 2 December 2019 (which includes Cyber Monday), we found a new leader emerge. After breaking into the top 10 for the first time in 2018, Amazon made its way to the top of the leaderboard this year with an 84% increase in national TV spend year-on-year (YoY). The e-tail king has been steadily increasing spend on TV in recent years after facing pressure from a growing number of retailers offering free same-day or next-day delivery.

Conversely, Walmart, once the leader of the pack, cut its TV spend for the second year in a row, dropping from the top spot for the first time in recent years. Despite declines from the majority of the top 10, the overall percent change from this group was only -1%. The double digit increases from Amazon, Kohl’s and Old Navy were large enough to make up for some of the lag.

Winter Holiday Season Retail Leaderboard National TV Advertising: 28 October - 2 December, 2019

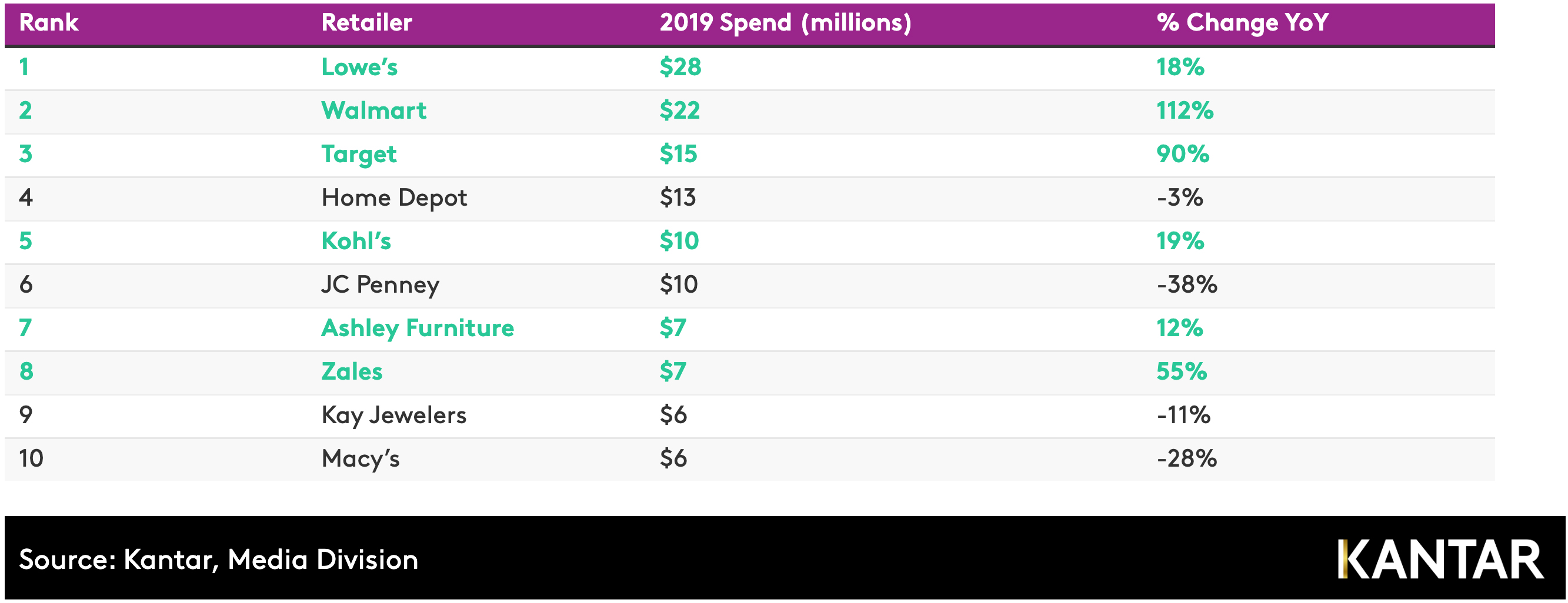

Black Friday bounces back

While retailers may be spending less overall, they are placing more of an emphasis on sale events to move their merchandise. In recent years we have seen less importance placed on “Black Friday” specific messaging, however 2019 told a different story. Spend on TV spots containing the term “Black Friday” increased by 23%, with retailers investing $146 million on commercials mentioning the sale event by name from 28 October – 2 December 2019 compared with just $124 million during the similar time last year.

This year, many retailers took advantage of the extra week leading into the season to reinforce their sale events; some, like Kohl’s, started offering Black Friday deals as early as 1 November. Retail leaders Walmart and Target doubled down on their Black Friday promotions in an effort to win early shoppers, while Zale’s and Lowe’s also saw considerable increases.

Black Friday Retail Leaderboard National TV Advertising: 28 October - 2 December, 2019

The extra promotions did not fall on deaf ears. The NRF reports that Thanksgiving weekend 2019 drew nearly 190 million shoppers, up 14% from 2018. Consumer spending increased in tandem, with shoppers shelling out an average of $361.90 on holiday items over the five-day period, an increase of 16% YoY.

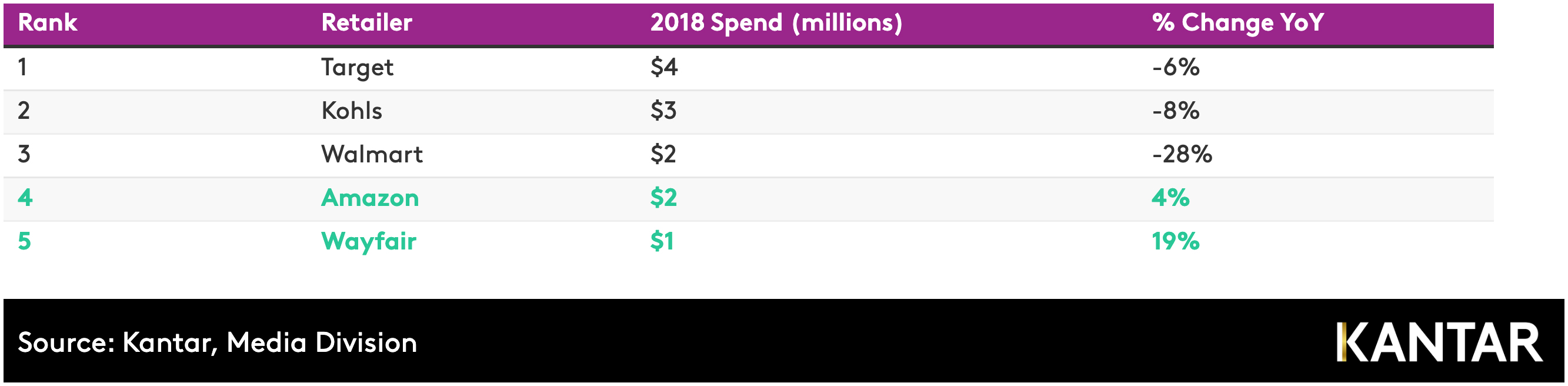

Cyber Monday falls by the wayside

While Black Friday made a comeback, Cyber Monday didn’t fare quite as well. Retailers spent only $15 million on Cyber Monday messaging in 2019, compared with $26 million in 2018. Despite more shopping being done online, Cyber Monday messaging hasn’t gained much traction in recent years.

Many retailers are now extending their “Cyber Monday” sales to last all week – or in some cases all season – so there is less urgency to get those ads out on the Monday following Thanksgiving. Some retailers even cut the term “Cyber Monday” from their TV promotions across the board. In 2018 we monitored 17 retailers mentioning the event in their TV ads, compared with just 11 in 2019.

Cyber Monday Retail Leaderboard National TV Advertising: 28 October 28 - 2 December, 2019

Interactive experience or striking an emotional chord?

Many brands have been trying to differentiate themselves with creative campaigns that either deliver some element of interactivity and experience or speak to a consumer’s emotions.

Pringles is one example. Cleverly promoting its partnership with the new Gears 5 first-person shooter game over the festive season, it has master-minded a gaming headset with an interactive twist. Designed by Grey New York, the headset doubles up as an automatic chip dispenser. The idea is that gamers with an insatiable appetite can keep playing while the Pringles Hunger Hammer feeds them chips – no hands required.

Bootique from Boots is another shining example of an interactive campaign. With pops-up and personalised activations, it aims to take the anxiety out of Christmas shopping. Using the power of film, created by Ogilvy, it introduces consumers to a better way of buying Christmas gifts. The campaign also invites customers to tailor gifts at a pop-up Bootique. With the help of WPP’s team WBA, the shop offers something for all personalities and characters from Tweenagers and beauty queens, to gym junkies and vegans.

The Going Home for the Holidays campaign for Pantene is more of a tear-jerker. It’s a touching portrayal of the struggles members of the LGBTQ community face when returning home for the holidays. Also created by Grey, the advert features the Trans Chorus of Los Angeles and real stories of some of its members. Singing I’ll Be Home for Christmas, it features clips of individuals preparing themselves for the journey ahead.

The advert, designed to inspire the LGBTQ community to be their true selves this Christmas, is a clever embodiment of Pantene’s own brand values too. The hair care retailer stands for inclusion and celebrating the beauty of all people.

Top Retailers in Paid Search Advertising, Black Friday-Cyber Monday 2019

Kantar also analysed paid search advertising performance by retailers during the 2019 Black Friday-Cyber Monday weekend. They looked at US Google text ad and product listing ad click share on 2,500 popular retail product keywords from 29 November through 2 December. Keyword examples include “xbox one”, “ps4”, “shoes”, “ipad” and “engagement rings”.

Walmart was the top performer out of 5,043 advertisers appearing in product listing ads (PLAs) for the 2,500 retail product keywords over the extended Black Friday-Cyber Monday weekend. The retail giant generated an 11.5% click share during the period. Walmart has been concentrating on PLAs rather than text ads in its paid search strategy in recent years and ranked 12th in text ads during the period.

Amazon ranked second in PLA clicks with a 7.8% click share from Black Friday to Cyber Monday, while also ranking first in text ads out of 3,523 advertisers, with a 7% click share. Amazon has been inconsistent in its use of PLAs in the past, perhaps because so many shoppers are going straight to Amazon to start their product searches.

Online home goods and furniture retailer Wayfair ranked second in text ads with a 3% click share and fourth in PLAs with a 3.6% click share.

Kohl’s took the third spot in PLAs with a 5.4% click share and seventh in text ads (1.3% click share). JCPenney ranked third in text ads with a 2.9% click share while also garnering a 2.9% click share in PLAs, though it was only enough to rank the retailer in the seventh position.

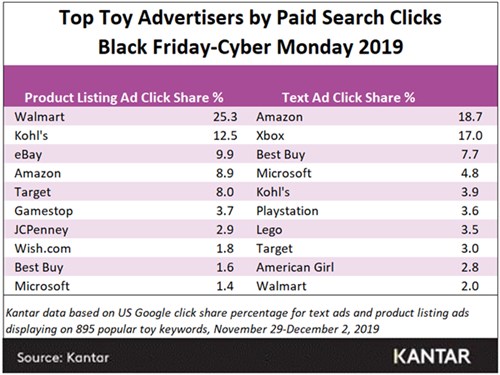

Top toy advertisers

Taking a deeper dive into one of the most popular holiday retail categories, Kantar also analysed product listing ad and text performance on 895 popular toys keywords over the Black Friday-Cyber Monday weekend, including “xbox one”, “toys”, “playstation 4”, “baby alive”, “lego”, “nerf guns", “calico critters” and “hatchimals”.

During the 4-day period we found product listing ads from 1,208 advertisers displaying on the toy keyword group. Walmart again led in PLA clicks, far surpassing the competition with a 25.3% click share. For comparison, the second ranked advertiser, Kohl’s, generated half as many clicks (12.5% click share) as Walmart, followed by eBay (9.9% click share), Amazon (8.9% click share) and Target (8% click share).

Within text ads, we observed 448 advertisers sponsoring the toy keyword group over the long weekend. Amazon was the top performer with an 18.7% text ad click share, followed closely by Xbox, which generated a 17% click share. Performance dropped considerably from there as the three advertisers rounding out the top ten gain single-digit click shares on the toy keywords: Best Buy (7.7% click share), Microsoft (4.8% click share) and Kohl’s (3.9% click share).

published on

20 December 2019

Category

More in Commerce

Media in India: the future is now

Brands pursuing the Indian market must focus on personalised experiences and data-driven strategies

Multinational companies must have an India strategy

The Indian market is hugely attractive to brands, but multinational companies must have a bespoke India strategy

Where there’s women’s health, there’s wealth

There’s huge economic advantage in closing the women’s health gap, and yet still this gap is still formidable