The full-funnel value of ecommerce

The benefits of using direct ecommerce channels beyond the checkout

Consumer businesses are missing an opportunity by investing in and measuring direct ecommerce channels with only the immediate conversion in mind.

When considering investment and strategies on direct channels – such as owned websites and apps – or semi-direct channels – such as brand-operated stores on marketplaces – consumer businesses of all types should think beyond the checkout.

The value to the brand of direct-to-consumer (D2C) commerce represents only the tip of the iceberg. Setting up and optimising ecommerce experiences should be done in a way that adds value throughout the full funnel. Similarly, the full-funnel value of ecommerce should be taken into account when considering investing in a D2C presence.

Indirect revenue (sales on other channels) should be calculated. This is because consumers may encounter brands for the first time through D2C ecommerce and build consideration from the brand’s content and experiences, but eventually purchase on other channels. The sale could be made shortly after or it could be weeks or months later.

Store conversion rates for many consumer categories are 1% to 10% – i.e. up to one in ten people who visit a store actually buy something during their visit. If that’s the case, what about the remaining nine visitors? Has their experience been positive enough for them to make that sale elsewhere, or at a later stage?

Furthermore, has the brand collected data in a way that allows it to reach out to the consumer in a more relevant, more direct, or more efficient way? With D2C, on an owned website or app, this could happen through the collection of first-party data or the placement of a pixel. On a marketplace such as Shopee or Tmall data could be collected from a store follow.

#1 Direct revenue – the immediate sale

Growth in ecommerce during COVID-19, coupled with evolving consumer habits, is transforming the D2C market. According to PwC data, D2C currently represents roughly 15% of ecommerce penetration globally.

In South East Asia this is set to grow rapidly. While online purchasing in the region has been slower to catch on, new technologies, new platforms and changing consumer expectations are accelerating the process. Internet penetration, digital payments and consumer trust in ecommerce all rose significantly in 2020. The region’s online industry is poised to triple to $309 billion in gross merchandise value by 2025.

#2 Indirect revenue

The above-mentioned direct revenue, currently small for many brands, represents only the tip of the iceberg in terms of potential value generated. This is because consumers, especially those in South East Asia, take different routes to arrive at the point of purchase. Oftentimes an experience on an ecommerce platform might simply be building upper-funnel awareness or mid-funnel consideration for a purchase made on another channel – perhaps offline or on an online marketplace.

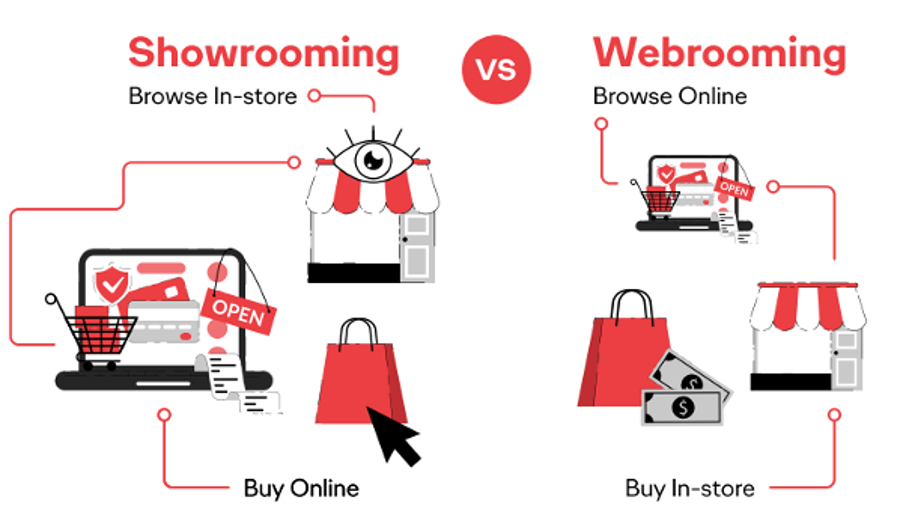

Showrooming – see it, touch it in-store, buy it online

Essentially, with showrooming, local stores become showrooms for online shoppers. Here, a shopper walks into a store and checks out a product. They hold it, feel it, try it. Then they walk out, go home and promptly purchase the product online.

Webrooming – see it, know it online, buy it in-store

Webrooming is the reverse behaviour to showrooming. Here, consumers trawl online for product information and price comparisons. Then they walk into the store for a final evaluation and make the purchase. A perfect case in point is the mobile phones market. In 2015, 54% of buyers in Singapore completed their phone purchase offline after researching, exploring and making their choices online.

#3 Brand building

As new opportunities emerge, both on D2C platforms and marketplaces, to engage consumers with content and experiences, there’s a corresponding opportunity for businesses to drive sales overnight, and brand over time.

Shoppertainment such as livestream and gamification on sites such as Shopee and Lazada are setting new expectations among consumers. Unlike on Amazon in the west, where the experience is designed to get shoppers to check out as quickly as possible, on Asian marketplaces consumers are encouraged to ‘hang out,’ with all kinds of content, games and social media functionality.

And this is not exclusively the realm of marketplaces. Increasingly brands are creating content and experiences that will be valuable to their consumers, right alongside the checkout on their D2C platforms. The intention is to create an experience that builds upper-funnel perceptions of the brand, even for those that don’t make the immediate sale.

The more direct the ecommerce experience, the more able the seller is to craft an experience that builds brand value.

#4 Data collection and insight

D2C ecommerce and the data it generates allows businesses to learn about their consumers and enable ongoing direct, personalised communications.

The data collected around an ecommerce interaction can add value in multiple ways. Collection of first-party personal data, for example, allows the brand to follow up with relevant communications in direct channels such as email or messenger. This enables lower-funnel loyalty behaviours. Another simple way is to place pixels and tags on different parts of the ecommerce experience to enable efficient, targeted communications in paid media channels.

As above, the more direct the experience, the more easily the brand can collect data and use it to create valuable experiences.

Opportunities at each stage of the funnel

A well-optimised store, with relevant content, will attract new customers with little or no awareness of your brand or products.

Marketplaces are investing more and more in their own ad products. These will deliver visibility and awareness among new customers.

Livestreaming allows brands to engage directly, often with the help of trusted influencers. Live streamers can share broader category-relevant, lifestyle information but also specific purchase calls-to-action throughout their show.

Other forms of shoppertainment, such as gamification, are key too in the mid funnel. Piggybacking on the existing games of marketplaces or creating gamified widgets on owned sites are great ways to engage, build consideration and collect valuable data.

Helpful content, including video and long-form written content, can build consideration and enable favourable comparison between brands.

Enabling a frictionless sale is critical. Clear calls-to-action and the relevant product and price information must be prominently visible at all opportunities.

Cross sell is critical too. This can be in the form of marketplace systems or recommendation widgets on owned sites.

Data should be collected throughout, be it first-party personal data that allows us to continue communication in direct channels or within the marketplaces or pixels that allow retargeting on other ad ecosystems.

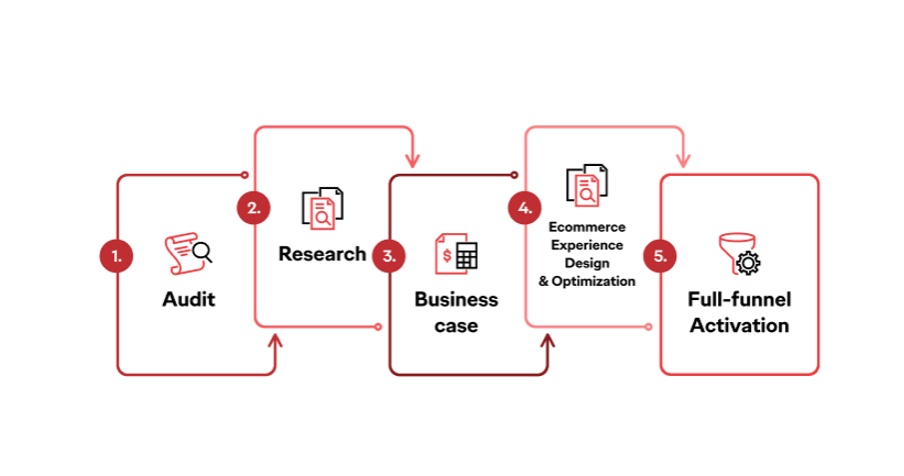

Actioning the full-funnel value of ecommerce:

Audit: understand how competitors, in relation to your brand, are making the most of ecommerce’s full-funnel opportunity.

Research: understand the customer journey and the “webrooming” impact that an ecommerce experience might have on other sales channels.

Business case: demonstrate that a sale through a direct or brand-operated channel is worth more than a sale through an indirect channel such as an online supermarket. Consider the value generated among the of the 90% of people that did not purchase then and there.

Ecommerce experience design and optimisation: set up or optimise your store, either as a fully D2C environment or a partially direct brand-operated marketplace. This needn’t mean a large outlay. A brand could add search-optimised content or experiences to an existing store or set up an MVP with a limited product range, for example.

Full-funnel activation: breakdown silos to create an always-on, full-funnel activation programme that uses ecommerce data to reach people and effectively and efficiently move them down the funnel to conversion, loyalty and advocacy.

published on

03 September 2021

Category

More in Commerce

Media in India: the future is now

Brands pursuing the Indian market must focus on personalised experiences and data-driven strategies

Multinational companies must have an India strategy

The Indian market is hugely attractive to brands, but multinational companies must have a bespoke India strategy

Where there’s women’s health, there’s wealth

There’s huge economic advantage in closing the women’s health gap, and yet still this gap is still formidable